This in-depth market data research is split into two key modules: Market Growth Outlook and Competitive Analysis. Each of these modules is further configured into several sub-modules to meet the needs of executives as well as marketing, sales, and product development managers. All of these modules and sub-modules may be purchased as a bundle or separately. A brief description of these modules, sub-modules, and their use cases is included below.

This Distributed Control Systems (DCS) for Power Generation market research delivers current market analysis plus a five year market and technology forecast. The research is available in multiple editions including worldwide, all regions, and most major countries. The research covers Electric Power Generation, Industrial Control Systems, Characterizable I/O, Configural I/O, Coal, Natural Gas, Nuclear. Oil, Renewables, Strategic Analysis, Market Size, Industry Trends.

ESG Initiatives Hindering Growth in Distributed Control System Investments from Utilities

The most important market trend in the electric power generation industry is the move to reduce the reliance on coal-fired generating capacity worldwide, due to higher carbon emissions. In general, aging coal plants are now more likely to be retired rather than updated and retrofitted with new features. This has been the case in Europe for some time, but today, new generating capacity planned in North America is predominantly wind and solar PV. The Chinese market, an important segment of the global market, is also ramping up the deployment of renewable generation. The implication of this for fossil-fired generating plants is that they will obtain a reduced share of future electric generation and thus will operate at lower capacity factors in the future. This will raise their overall plant cost metrics, such as “levelized cost of electricity” (LCOE). That in turn will make new investments in these types of plants more challenging to justify economically, even though fossil-fueled generation will remain vital to overall electric systems.

The growing emphasis toward lowering carbon emissions has resulted in smaller unit sizes (by a factor of roughly 100) that do not require full scale Distributed Control Systems. Industrial PCs and/or PLCs are often sufficient. There are benefits in larger scale automation for such installations, but most have been developed by non-utility firms and these developers have usually not concerned themselves with long-term operational issues

Distributed Control Systems for Power Generation Strategic Issues

In addition to providing a five-year market forecast, the Distributed Control Systems for Power Generation market research provides detailed quantitative current market data and addresses key strategic issues as follows.

In addition to providing a five-year market forecast, the Distributed Control Systems for Power Generation market research provides detailed quantitative current market data and addresses key strategic issues as follows.

Take Advantage of the Benefits Offered through Virtualization

Industrial control system (ICS) virtualization offers clear benefits for end users. These include lower TCO, longer ICS life, fewer disruptive changes, and improved ability to manage change and implement continuous improvement. The largest payoff comes from reduced obsolescence. End user organizations should study the virtualization strategies of their potential future ICS suppliers, paying special attention to supplier plans for migrating existing installations (including controllers) to a future virtualized runtime environment.

Consider Characterizable or Configurable I/O

End users should consider adopting the new breed of I/O. Leading automation suppliers have developed a new I/O that is either characterizable, configurable, or a combination of the two. Characterizable I/O includes hardware modules that plug into a rack and can represent analog input, analog output, digital input, digital output, etc. The type of module plugged into the rack determines the type of signal. Modules can be plugged anywhere in the rack and are location independent. Configurable I/O solutions take a similar approach in terms of point independence and flexibility, but the I/O points are configured through software rather than hardware modules. Some vendor solutions offer a combination of characterizable and configurable I/O. Vendors also offer software tools to support the commissioning and integration of smart I/O cabinets without a complete DCS.

The benefits of characterizable and configurable I/O go beyond simply reduced hardware, footprint, and wiring. They allow end users to separate the hardware-related and software-related aspects of the system. With fully adaptable and standard I/O and control hardware, end users can theoretically design and test all the software aspects of the system before it is deployed to the target system hardware. This allows the software to be deployed into the hardware infrastructure at the very late stages of the project. Often referred to as “late binding,” this can compress capital project schedules, reduce risks, and shorten the time to production.

Supplier Expertise and Support

As end user organizations downsized, many lost expertise from their in-house process automation groups. The aging workforce and retirements have also contributed to lost expertise. In many cases, users have supplanted this expertise cost-effectively using the services of knowledgeable DCS supplier personnel with expertise in engineering, maintaining, and optimizing the DCS.

Except for very large and sophisticated multinational corporations, end users should consider turning to suppliers to design and commission Ethernet networks with ultra-high availability and uninterrupted network service through multiple failure modes. Providing the necessary degree of isolation between DCS and corporate network functions to ensure safety and security, while at the same time allowing appropriate information from the DCS to flow to enterprise networks, requires the knowledgeable use of servers and other network infrastructure such as routers, switches, and firewalls.

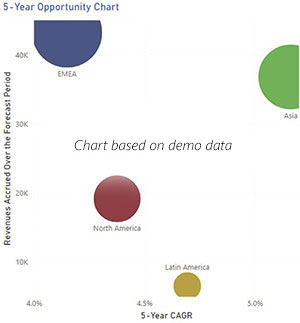

ARC’s market growth outlook service delivers an in-depth market opportunity analysis including five-year market and technology forecasts and 3-year history trend lines where available. Besides providing an in-depth analysis of the market opportunity provided by each technology, this service allows technology suppliers to analyze their own customized markets consisting of multiple technologies. For example, customers can view different market scenarios by adding or removing technology markets from the analysis, providing them a Total Available Market (TAM) view of their own served market. A list of the available market growth outlook services can be seen in the list below.

This service is designed to help accelerate your organization's ability to understand an up-to-date view of the market opportunity provided by your current product portfolio and analyze how your company’s market opportunity would change if you were to acquire or divest a particular product line. The service will also help you identify and capitalize on emerging markets, whether these markets are based on an emerging technology, region, vertical industry, or application. Built upon a proprietary market model and ARC’s field proven primary research, this service helps product and marketing managers optimize their business plans by identifying the opportunities provided by emerging trends. ARC’s reputation as the preeminent independent provider of market growth opportunity analyses for nearly four decades also provides greater weight to your business plans. ARC’s market growth outlook services are available in a variety of formats depending on whether you view your market opportunities via different technologies, industries, or world regions.

In addition, ARC has a strong history of providing customized market opportunity reports and services to meet your specific needs. For example, you may sell your products only to specific industries and/or in only one or two regions. You tell us your served markets and ARC can quickly configure a report or service designed to best serve your served market.

ARC provides several versions of these reports and services depending on your role in the organization. Executive Views are high level market opportunities designed to help executives quickly identify key trends and market opportunities around the world. In-depth market opportunity analyses provide marketing and product managers more detailed technology specific market information to plan marketing and product development strategies. The following table shows more specific information included in each version.

| Market Growth Outlook Analysis | Use Cases | Target Role |

| Worldwide Market Growth Outlook by Industry & Region with 3-year history where available | In-depth technology-specific strategic growth planning across multiple technologies, applications, regions, and industries | Product & Marketing Managers |

| Worldwide Industry Growth Outlook by Region with 3-year history where available | Strategic technology growth planning for markets defined by a single or multiple vertical industries | Industry Managers |

| Regional/Country Market Growth Outlook by Technology & Industry with 3-year history where available (includes country data) | Strategic technology growth planning for markets defined by a single or multiple world regions | Regional & Country Sales Managers |

| Market Growth Outlook Executive View | Strategic Total Available Market (TAM) growth planning dashboard covering multiple vertical industries, technologies, and world regions | Executives |

ARC’s Competitive Analysis services deliver in depth competitive analyses across multiple technologies, applications, regions, and industries. Besides providing an in-depth analysis of the market opportunity provided by each technology, this service allows technology suppliers to analyze their own customized markets consisting of multiple technologies. For example, customers can view different market scenarios by adding or removing technology markets from the analysis, providing them a Total Available Market (TAM) view of their own served market. A list of the available market growth outlook services can be seen in the list below.

This service is designed to help product and marketing managers identify their company’s market positioning across multiple views within their Serviceable Available Market (SAM). Built upon a proprietary market model and ARC’s field proven primary research, this service helps product and marketing managers optimize their business plans by identifying how their company’s market position would change if the company were to acquire or divest a particular product line or technology. ARC’s reputation as the preeminent independent provider of competitive market benchmarking for nearly four decades lends greater weight to your business plans. ARC’s market competitive services are available in a variety of formats depending on whether you view your market opportunities via different technologies, industries, or world regions.

In addition, ARC has a strong history of providing customized market opportunity reports and services to meet the specific needs of our clients. For example, you may sell your products only to specific industries and/or in only one or two regions. You tell us your served markets and ARC can quickly configure a report or service designed to best serve your served market.

ARC provides several versions of these reports and services depending on your role in the organization. Executive Views are high level market competitive analyses designed to help executives quickly assess their SAM by world region, technology, or vertical industry. In-depth competitive market analyses provide marketing and product managers more detailed technology specific benchmarking information to plan marketing and product development strategies. The following table shows more specific information included in each version.

| Competitive Analysis | Use Cases | Target Role |

| Worldwide Competitive Analysis by Technology | In-depth competitive market analysis that quantifies how your company’s market position has changed over time across multiple technologies, applications, regions, and industries | Product & Marketing Managers |

| Worldwide Competitive Analysis by Industry | Strategic technology-based competitive analyses for markets defined by a single or multiple vertical industries | Industry Managers |

| Regional/Country Competitive Analysis by Industry | Strategic technology-based competitive analyses for markets defined by a single or multiple world regions | Regional Sales Managers |

| Competitive Analysis Executive View | Strategic Serviceable Available Market (SAM) analysis dashboard covering multiple vertical industries, technologies, and world regions | Executives |

Worldwide Research Focus Areas

Profiles for the major suppliers servicing this market are included.

Regional Research Focus Areas

For More Information

For more information or to purchase the Distributed Control Systems for Power Generation Industry Market Research study, please contact us.

Learn more about ARC In-depth Research at Market Data Services

Learn more about ARC Strategic Services at Advisory Services for Industry Leaders