This in-depth market data research is split into two key modules: Market Growth Outlook and Competitive Analysis. Each of these modules is further configured into several sub-modules to meet the needs of executives as well as marketing, sales, and product development managers. All of these modules and sub-modules may be purchased as a bundle or separately. A brief description of these modules, sub-modules, and their use cases is included below.

The Plant Asset Management market research delivers current market analysis plus a five year market and technology forecast. The research is available in multiple editions including worldwide, all regions, and most major countries. The research covers plant asset management, comprehensive asset management strategies, production assets, automation assets, Industrial IoT technologies, asset health monitoring, preventing unplanned downtime, strategic analysis, market size, industry trends, historical analysis.

Benefits of Asset Management Drive the PAM Market

ARC defines Plant Asset Management (PAM) systems as a combination of hardware, software, and services intended to assess the health of plant assets by monitoring asset condition to identify potential problems before they escalate. The severity of problem, potential causes, and possible operator actions can be provided to determine necessary actions. Plant asset management provides predictive asset health information by using data embedded in smart field devices, control systems, and various sensors with an intelligent analytical engine to predict potential asset problems. Information derived from PAM systems can be used to optimize maintenance and operations, increase production availability, and enable a predictive maintenance strategy.

Plant Asset Management Strategic Issues

In addition to providing a five-year market forecast, the Plant Asset Management market research provides detailed quantitative current market data and addresses key strategic issues as follows.

In addition to providing a five-year market forecast, the Plant Asset Management market research provides detailed quantitative current market data and addresses key strategic issues as follows.

Enable Maintenance Staff to Leverage PAM Solutions

In the past few years, PAM end users have focused on educating their maintenance and operations teams on the benefits of PAM systems to encourage PAM solution adoption. However, many key functionalities of PAM systems may remain unexplored. To get the maximum benefit out of their PAM investments, users must put in an extra effort on their part to learn and train their staff on how to effectively use PAM systems. End users should involve the maintenance people who will use the PAM system from the beginning of the PAM initiative. End users should also review ongoing asset management practices from time to time and incorporate training as needed. As the COVID-19 pandemic limited operations for many end users, they utilized this time to revisit their training needs and work with suppliers to get the needed training(s).

Highlight Plant Asset Management Benefits

A lot has changed in the last few years, and many end users now plan and budget for PAM initiatives. However, there are many users that are slow to undertake PAM initiatives. For those, just getting started on their PAM journey, developing a business case for PAM investments should be the first step. Doing so will require the end user to identify the problems PAM solutions will solve and quantify potential savings. From here, the organization can determine the level of investment that they are willing to approve.

Any savings resulting from the implementation of PAM systems can be applied directly to the bottom line, making them good investments regardless of the business environment. When maintenance is incorporated into the overall enterprise strategy, PAM provides a competitive advantage. In the short-term, end users all over the world are going to be cautious about their spending, due to the pandemic and resulting slowdown in global economies. ARC also expects some slowdown in PAM investments in the near future. However, end users should look at the long-term benefits of PAM investments. Many PAM initiatives may also result in short-term savings as well. Moreover, some investments may be needed just to keep the operations going. For example, when the pandemic-related restrictions hit, many end users were able to leverage their Industrial IoT investments to adapt to the new working environment.

Strive for Comprehensive Asset Management Strategy

Initial target applications for Industrial IoT technologies involve asset health monitoring for preventing unplanned downtime. Future projects, upgrades, or expansions that do not include the ability to monitor asset health is a lost opportunity. At minimum, project design should include the infrastructure to monitor assets in the future, if not immediately to facilitate the addition of monitoring sensors later at a minimal cost.

Owner/operators that have not yet undertaken Industrial IoT pilot projects should do so to obtain a basic understanding of the technologies and communication infrastructure to support it as well as the benefits that can be derived. ARC recommends experimenting with “bad actor” assets to evaluate technologies and redesign work processes. However, be aware that technology alone may not produce the intended results. Digital transformation requires shifts in organizational accountability, culture, and change management. Enterprises that overlook the organizational aspects of transformation may experience challenges in scaling pilot programs into full-scale operations.

Industrial IoT will provide opportunities for owner/operators to improve overall business performance in innovative ways. In this early phase of Industrial IoT maturity, asset management is a popular target among manufacturers. The challenge is to ascertain how to leverage these disruptive technologies to improve asset management processes to reap the benefits of reduced unplanned downtime and extend asset life with lower maintenance costs.

A comprehensive strategy for managing assets should provide owner/operators with an understanding of the effectiveness of assets utilized in the production process. This understanding of the asset base enables the development of maintenance strategies for individual assets according to its criticality to the manufacturing process. Asset management strategies should also include data governance parameters and details on how information will be shared, who should have access, and application integration among operations and maintenance to provide a comprehensive view of production and performance. In addition, owner/operators need to ensure that the infrastructure to support access to asset data is efficient and effective. Training requirements for both maintenance and operations personnel should not be overlooked in strategy development.

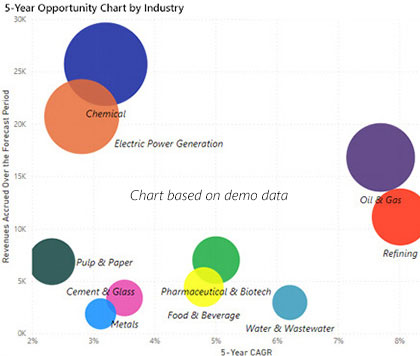

ARC’s market growth outlook service delivers an in-depth market opportunity analysis including five-year market and technology forecasts and 3-year history trend lines where available. Besides providing an in-depth analysis of the market opportunity provided by each technology, this service allows technology suppliers to analyze their own customized markets consisting of multiple technologies. For example, customers can view different market scenarios by adding or removing technology markets from the analysis, providing them a Total Available Market (TAM) view of their own served market. A list of the available market growth outlook services can be seen in the list below.

This service is designed to help accelerate your organization's ability to understand an up-to-date view of the market opportunity provided by your current product portfolio and analyze how your company’s market opportunity would change if you were to acquire or divest a particular product line. The service will also help you identify and capitalize on emerging markets, whether these markets are based on an emerging technology, region, vertical industry, or application. Built upon a proprietary market model and ARC’s field proven primary research, this service helps product and marketing managers optimize their business plans by identifying the opportunities provided by emerging trends. ARC’s reputation as the preeminent independent provider of market growth opportunity analyses for nearly four decades also provides greater weight to your business plans. ARC’s market growth outlook services are available in a variety of formats depending on whether you view your market opportunities via different technologies, industries, or world regions.

In addition, ARC has a strong history of providing customized market opportunity reports and services to meet your specific needs. For example, you may sell your products only to specific industries and/or in only one or two regions. You tell us your served markets and ARC can quickly configure a report or service designed to best serve your served market.

ARC provides several versions of these reports and services depending on your role in the organization. Executive Views are high level market opportunities designed to help executives quickly identify key trends and market opportunities around the world. In-depth market opportunity analyses provide marketing and product managers more detailed technology specific market information to plan marketing and product development strategies. The following table shows more specific information included in each version.

| Market Growth Outlook Analysis | Use Cases | Target Role |

| Worldwide Market Growth Outlook by Industry & Region with 3-year history where available | In-depth technology-specific strategic growth planning across multiple technologies, applications, regions, and industries | Product & Marketing Managers |

| Worldwide Industry Growth Outlook by Region with 3-year history where available | Strategic technology growth planning for markets defined by a single or multiple vertical industries | Industry Managers |

| Regional/Country Market Growth Outlook by Technology & Industry with 3-year history where available (includes country data) | Strategic technology growth planning for markets defined by a single or multiple world regions | Regional & Country Sales Managers |

| Market Growth Outlook Executive View | Strategic Total Available Market (TAM) growth planning dashboard covering multiple vertical industries, technologies, and world regions | Executives |

ARC’s Competitive Analysis services deliver in depth competitive analyses across multiple technologies, applications, regions, and industries. Besides providing an in-depth analysis of the market opportunity provided by each technology, this service allows technology suppliers to analyze their own customized markets consisting of multiple technologies. For example, customers can view different market scenarios by adding or removing technology markets from the analysis, providing them a Total Available Market (TAM) view of their own served market. A list of the available market growth outlook services can be seen in the list below.

This service is designed to help product and marketing managers identify their company’s market positioning across multiple views within their Serviceable Available Market (SAM). Built upon a proprietary market model and ARC’s field proven primary research, this service helps product and marketing managers optimize their business plans by identifying how their company’s market position would change if the company were to acquire or divest a particular product line or technology. ARC’s reputation as the preeminent independent provider of competitive market benchmarking for nearly four decades lends greater weight to your business plans. ARC’s market competitive services are available in a variety of formats depending on whether you view your market opportunities via different technologies, industries, or world regions.

In addition, ARC has a strong history of providing customized market opportunity reports and services to meet the specific needs of our clients. For example, you may sell your products only to specific industries and/or in only one or two regions. You tell us your served markets and ARC can quickly configure a report or service designed to best serve your served market.

ARC provides several versions of these reports and services depending on your role in the organization. Executive Views are high level market competitive analyses designed to help executives quickly assess their SAM by world region, technology, or vertical industry. In-depth competitive market analyses provide marketing and product managers more detailed technology specific benchmarking information to plan marketing and product development strategies. The following table shows more specific information included in each version.

| Competitive Analysis | Use Cases | Target Role |

| Worldwide Competitive Analysis by Technology | In-depth competitive market analysis that quantifies how your company’s market position has changed over time across multiple technologies, applications, regions, and industries | Product & Marketing Managers |

| Worldwide Competitive Analysis by Industry | Strategic technology-based competitive analyses for markets defined by a single or multiple vertical industries | Industry Managers |

| Regional/Country Competitive Analysis by Industry | Strategic technology-based competitive analyses for markets defined by a single or multiple world regions | Regional Sales Managers |

| Competitive Analysis Executive View | Strategic Serviceable Available Market (SAM) analysis dashboard covering multiple vertical industries, technologies, and world regions | Executives |

Worldwide Research Focus Areas

Strategic Analysis

- Executive Overview

- Market Trends

- Buyer Strategies

- Supplier Strategies

- Growth Contributors and Inhibitors

Competitive Analysis

- Market Shares of the Leading Suppliers

- Market Shares by Region

- North America

- Europe, Middle East, Africa

- Asia

- Latin America

- Market Shares by Revenue Category

- Hardware

- Software

- Services

- Market Shares by Asset Type

- Production Assets

- by Industry

- by Revenue Category

- by Technology

- by Network Technology

- by Deployment Option

- by Communication Network

- Automation Assets

- by Industry

- by Revenue Category

- by Technology

- by Network Technology

- by Deployment Option

- by Communication Network

- Production Assets

- Market Shares by Industry

- Chemical

- Electric Power Generation

- Food & Beverage

- Metals

- Mining

- Oil & Gas

- Pharmaceutical & Biotech

- Pulp & Paper

- Refining

- Water & Wastewater

- Market Shares by Business System Integration

- Market Shares by Sales Channel

Market Forecasts

- Total Shipments of Plant Asset Management Systems

- Shipments by Region

- North America

- Europe, Middle East, Africa

- Asia

- Latin America

- Shipments by Revenue Category

- Hardware

- Software

- Services

- Shipments by Asset Type

- Production

- by Industry

- by Revenue Category

- by Technology

- by Network Technology

- by Deployment Option

- by Communication Network

- Automation

- by Industry

- by Revenue Category

- by Technology

- by Network Technology

- by Deployment Option

- by Communication Network

- Production

- Shipments by Industry

- Chemical & Petrochemical

- Electric Power Generation

- Food & Beverage

- Metals

- Mining

- Oil & Gas

- Pharmaceutical & Biotech

- Pulp & Paper

- Refining

- Water & Wastewater

- Shipments by Business System Integration

- Shipments by Sales Channel

Industry Participants

The research identifies all relevant suppliers serving this market.

Regional Research Focus Areas

Strategic Analysis

Competitive Analysis

- Leading Suppliers in Region

- Industry Shares in Region

- Country Shares in Region

- Leading Suppliers by Industry

Market Forecasts

- Market Forecast by Country

- Market Forecast by Industry

Industry Participants

List of countries included in each region: MIRA-Country

For More Information

For more information or to purchase the Plant Asset Management Market Research, please contact us.

Learn more about ARC In-depth Research at Market Data Services

Learn more about ARC Strategic Services at Advisory Services for Industry Leaders