This in-depth market data research is split into two key modules: Market Growth Outlook and Competitive Analysis. Each of these modules is further configured into several sub-modules to meet the needs of executives as well as marketing, sales, and product development managers. All of these modules and sub-modules may be purchased as a bundle or separately. A brief description of these modules, sub-modules, and their use cases is included below.

This Supply Chain Planning (SCP) market research delivers current market analysis plus a five year market and technology forecast. The study is available in multiple editions including worldwide, all regions, and most major countries. This supply chain planning research covers digitally transforming the end-to-end supply chain, demand planning, inventory optimization, network design, agility, resilience, strategic analysis, market size, industry trends, historical analysis.

The Supply Chain Planning Market Continues to Grow by Double Digits

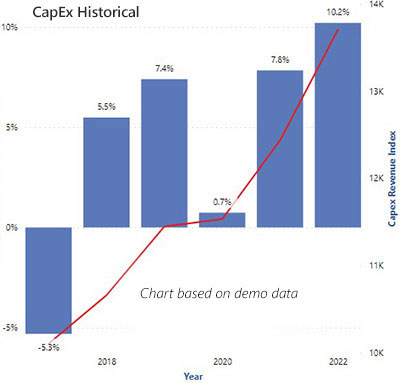

According to ARC Advisory Group research, the supply chain planning software market grew at a double-digit rate over the last several years, even during the pandemic. It is unusual for a mature, multibillion-dollar market to grow so fast. Clearly, the pandemic, although now post-pandemic, continues to be a driver of growth for this multibillion-dollar market. The pandemic highlighted the need for companies to be agile and resilient. Agility and resilience continue to be key goals among C-level executives. Executives largely do not believe that we will have smooth and predictable supply chains that were prevalent several years ago. Supply chain planning is one key technology for achieving these goals.

Supply Chain Planning Strategic Issues

In addition to providing a five-year market forecast, the Supply Chain Planning market research provides detailed quantitative current market data and addresses key strategic issues.

In addition to providing a five-year market forecast, the Supply Chain Planning market research provides detailed quantitative current market data and addresses key strategic issues.

Beware the Digital Twin Hype

A digital twin is a virtual representation that serves as the real-time digital counterpart of a physical object or process. The term “virtual representation” in SCP means a model. We should not be speaking of a digital twin, singular, but digital twins, plural. Different types of models are good for solving different kinds of problems. The demand model is different from the supply model. In terms of supply modeling, many companies will find that they need one model for supply chain design, another for tactical planning, and another for operational planning. Models are getting broader and deeper, and this is to be applauded. Where a supply network model used to consist of a model of multiple factories and warehouses, today we are seeing models that include a much broader set of constraints: purchase agreements, store replenishment, transportation, ESG, and others as well. These broader models are better models.

Do Not Customize the Software

Over the years, ARC has come across many companies that purchased supply chain software and then customized it so that it would better fit their processes and culture. The implementations take longer when customization is involved. Furthermore, as the software was customized, customers were reluctant to upgrade the software because of the large costs associated with upgrading software that has been customized. This reluctance to upgrade customized software can continue for several years and the buyers forego product enhancements. After some number of years, while falling further and further behind the current version of the software, the companies realize that they have legacy software. If they want to use a modern solution, the costs will be so high that they may as well go through a new vendor selection process and a brand-new implementation.

There is a marked trend toward purchasing cloud-based solutions. This is not just because cloud solutions are sold in a Software-as-a-Service (SaaS) model that lowers upfront costs but also because public cloud solutions typically do not allow for customization and thus protect the upgrade path. In short, avoiding customization improves the total cost of ownership based on faster implementations, easier upgrades, and improved maintenance. However, there are still some companies that can plausibly argue that off-the-shelf software does not suit their needs. In supply chain planning, that often means they believe that the addition of a particular algorithm, or algorithms, will improve the optimization to such an extent that the extra costs do not matter. A few providers of SCP have public cloud solutions that allow custom algorithms to be put in a library attached to the platform; this is done in such a way that the upgrade path is still protected. That is the best of both worlds.

Public cloud solutions also allow for best practice benchmarking. For example, a demand/inventory optimization solution running in a public cloud allows the supplier to access the data, anonymize it, and then generate benchmarks that allow companies to see how they are performing on measures of forecast accuracy and inventory success measures relative to their peers.

Embrace Demand Sensing and Other Data Sources

Traditional demand forecasting is based on the presumption that history repeats itself. Even in the best of times, this method has limitations. During the pandemic, it completely failed. For companies trying to predict demand in March of 2020 as the world was descending into lockdown and everything was being turned upside down, what happened in March of 2019 had little to no relevance. The pandemic created seismic changes in customer behavior. Companies that made use of planning systems that combined demand sensing – the use of multiple, real-time signals (like sales in a particular store or shipments from a retailer’s warehouses to their stores) – and machine learning, produced more accurate forecasts in almost all instances. In times of dramatic swings in demand, demand sensing forecasts are even better–they adjust to the swings in demand much more quickly.

ARC’s market growth outlook service delivers an in-depth market opportunity analysis including five-year market and technology forecasts and 3-year history trend lines where available. Besides providing an in-depth analysis of the market opportunity provided by each technology, this service allows technology suppliers to analyze their own customized markets consisting of multiple technologies. For example, customers can view different market scenarios by adding or removing technology markets from the analysis, providing them a Total Available Market (TAM) view of their own served market. A list of the available market growth outlook services can be seen in the list below.

This service is designed to help accelerate your organization's ability to understand an up-to-date view of the market opportunity provided by your current product portfolio and analyze how your company’s market opportunity would change if you were to acquire or divest a particular product line. The service will also help you identify and capitalize on emerging markets, whether these markets are based on an emerging technology, region, vertical industry, or application. Built upon a proprietary market model and ARC’s field proven primary research, this service helps product and marketing managers optimize their business plans by identifying the opportunities provided by emerging trends. ARC’s reputation as the preeminent independent provider of market growth opportunity analyses for nearly four decades also provides greater weight to your business plans. ARC’s market growth outlook services are available in a variety of formats depending on whether you view your market opportunities via different technologies, industries, or world regions.

In addition, ARC has a strong history of providing customized market opportunity reports and services to meet your specific needs. For example, you may sell your products only to specific industries and/or in only one or two regions. You tell us your served markets and ARC can quickly configure a report or service designed to best serve your served market.

ARC provides several versions of these reports and services depending on your role in the organization. Executive Views are high level market opportunities designed to help executives quickly identify key trends and market opportunities around the world. In-depth market opportunity analyses provide marketing and product managers more detailed technology specific market information to plan marketing and product development strategies. The following table shows more specific information included in each version.

| Market Growth Outlook Analysis | Use Cases | Target Role |

| Worldwide Market Growth Outlook by Industry & Region with 3-year history where available | In-depth technology-specific strategic growth planning across multiple technologies, applications, regions, and industries | Product & Marketing Managers |

| Worldwide Industry Growth Outlook by Region with 3-year history where available | Strategic technology growth planning for markets defined by a single or multiple vertical industries | Industry Managers |

| Regional/Country Market Growth Outlook by Technology & Industry with 3-year history where available (includes country data) | Strategic technology growth planning for markets defined by a single or multiple world regions | Regional & Country Sales Managers |

| Market Growth Outlook Executive View | Strategic Total Available Market (TAM) growth planning dashboard covering multiple vertical industries, technologies, and world regions | Executives |

ARC’s Competitive Analysis services deliver in depth competitive analyses across multiple technologies, applications, regions, and industries. Besides providing an in-depth analysis of the market opportunity provided by each technology, this service allows technology suppliers to analyze their own customized markets consisting of multiple technologies. For example, customers can view different market scenarios by adding or removing technology markets from the analysis, providing them a Total Available Market (TAM) view of their own served market. A list of the available market growth outlook services can be seen in the list below.

This service is designed to help product and marketing managers identify their company’s market positioning across multiple views within their Serviceable Available Market (SAM). Built upon a proprietary market model and ARC’s field proven primary research, this service helps product and marketing managers optimize their business plans by identifying how their company’s market position would change if the company were to acquire or divest a particular product line or technology. ARC’s reputation as the preeminent independent provider of competitive market benchmarking for nearly four decades lends greater weight to your business plans. ARC’s market competitive services are available in a variety of formats depending on whether you view your market opportunities via different technologies, industries, or world regions.

In addition, ARC has a strong history of providing customized market opportunity reports and services to meet the specific needs of our clients. For example, you may sell your products only to specific industries and/or in only one or two regions. You tell us your served markets and ARC can quickly configure a report or service designed to best serve your served market.

ARC provides several versions of these reports and services depending on your role in the organization. Executive Views are high level market competitive analyses designed to help executives quickly assess their SAM by world region, technology, or vertical industry. In-depth competitive market analyses provide marketing and product managers more detailed technology specific benchmarking information to plan marketing and product development strategies. The following table shows more specific information included in each version.

| Competitive Analysis | Use Cases | Target Role |

| Worldwide Competitive Analysis by Technology | In-depth competitive market analysis that quantifies how your company’s market position has changed over time across multiple technologies, applications, regions, and industries | Product & Marketing Managers |

| Worldwide Competitive Analysis by Industry | Strategic technology-based competitive analyses for markets defined by a single or multiple vertical industries | Industry Managers |

| Regional/Country Competitive Analysis by Industry | Strategic technology-based competitive analyses for markets defined by a single or multiple world regions | Regional Sales Managers |

| Competitive Analysis Executive View | Strategic Serviceable Available Market (SAM) analysis dashboard covering multiple vertical industries, technologies, and world regions | Executives |

Worldwide Research Focus Areas

Strategic Analysis

- Executive Overview

- Major Trends

- Strategies for Success

- For Buyers

- For Suppliers

- Growth Contributors and Inhibitors

Competitive Analysis

- Market Shares of the Leading Suppliers

- Market Shares by Region

- North America

- Europe, Middle East, Africa

- Asia

- Latin America

- Market Shares by Revenue Type

- Software

- Services

- Market Shares by Service Type

- Implementation

- Maintenance & Support

- SaaS and Hosting

- Market Shares by Application Type

- Demand Management/Inventory Optimization

- Network Planning

- Supply Planning

- Market Shares by Industry

- Aerospace & Defense

- Automotive

- Chemical

- Electronics & Electrical

- Food & Beverage

- Household & Personal Care

- Logistics

- Machinery Manufacturing

- Medical Products

- Metals

- Oil & Gas

- Pharmaceutical & Biotech

- Retail

- Semiconductors

- Wholesale/Distribution

- Market Shares by Customer Tier

Market Forecasts and Histories

- Total Supply Chain Planning Business

- Shipments by Region

- North America

- Europe, Middle East, Africa

- Asia

- Latin America

- Shipments by Revenue Type

- Software

- Services

- Shipments by Service Type

- Implementation

- Maintenance & Support

- SaaS and Hosting

- Shipments by Application Type

- Demand Management/Inventory Optimization

- Network Planning

- Supply Planning

- Shipments by Industry

- Aerospace & Defense

- Automotive

- Chemical

- Electronics & Electrical

- Food & Beverage

- Household & Personal Care

- Logistics

- Machinery Manufacturing

- Medical Products

- Metals

- Oil & Gas

- Pharmaceutical & Biotech

- Retail

- Semiconductors

- Wholesale/Distribution

- Shipments by Customer Tier

Industry Participants

The research identifies all relevant suppliers serving this market.

Regional Research Focus Areas

Strategic Analysis

Competitive Analysis

- Leading Suppliers in Region

- Industry Shares in Region

- Country Shares in Region

- Leading Suppliers by Industry

Market Forecast and History Analysis

- Market History & Forecast by Country

- Market History & Forecast by Industry

Industry Participants

For More Information

For more information or to purchase the Supply Chain Planning Market Research study, please contact us.

Learn more about ARC In-depth Research at Market Data Services

Learn more about ARC Strategic Services at Advisory Services for Industry Leaders