This in-depth market data research is split into two key modules: Market Growth Outlook and Competitive Analysis. Each of these modules is further configured into several sub-modules to meet the needs of executives as well as marketing, sales, and product development managers. All of these modules and sub-modules may be purchased as a bundle or separately. A brief description of these modules, sub-modules, and their use cases is included below.

The Geared Motors Market Research delivers current market analysis plus a five year market and technology forecast. It is available in multiple editions including worldwide, all regions, and most major countries.

Digitalization Restructures the Market for Geared Motors

ARC’s market research on Geared Motors reveals that the digitalization of industrial processes is supported by the integration of drives, PLCs, and geared motors. Geared motors help enhance the operation of industrial facilities by supplying information about real-time motor driving characteristics, which indicate states of the drive mechanism and the machinery. This data may be leveraged in edge devices and cloud infrastructure. Geared motors are gaining market share as their modular design and flexible usage make it cost-effective. Machines and industries around the world are being restructured because of digitalization and increased connectivity. Industrial devices equipped with geared motors may now be operated and monitored more intelligently than before, independent of location.

Geared motors are used in material handling applications and are therefore found in several industry verticals. Market growth drivers include a steady demand from the food & beverage industry and long-term growth in the transportation & logistics sector. Road construction machinery is a major end user of geared motors. Geared motors are getting smarter and more sophisticated, with features such as program execution in addition to fundamental motor controls. Geared motors with condition-based monitoring capabilities give feedback on the drive, motor, and application‘s health. Analytical signals are used to initiate maintenance and enhance system design.

Geared Motors Strategic Issues

In addition to providing a five-year market forecast, the Geared Motors market research provides detailed quantitative current market data and addresses key strategic issues as follows.

In addition to providing a five-year market forecast, the Geared Motors market research provides detailed quantitative current market data and addresses key strategic issues as follows.

Standardization

It is crucial to strike a balance between employing a chosen range of geared motors with torque ratings that can be utilized across a broad variety of applications and using solutions that are specifically tailored to each application. Standardization minimizes inventory holding costs by minimizing the number of spare parts. Standardization on a small number of geared motors, on the other hand, will result in the use of larger motors in most applications. When utilized below full load, this will increase energy consumption, notably in the costlier IE4 motors, which lose the efficiency benefit. It is not cost effective to standardize a few motors and pay a premium for high-efficiency motors.

Identify Critical Applications and Use Condition Monitoring

Prioritize identifying key applications and ensure that they are provided with dependable, appropriately sized geared motors and that the lines are constructed with redundancy if necessary. Condition monitoring on those devices is critical for reducing and controlling exchange times and avoiding output loss. Many geared motors include built-in condition monitoring or may be linked to a third-party system. Although this has become the standard, proper and consistent use of this functionality is still uncommon. Preventive or, better still, predictive condition monitoring must become the norm in critical applications.

Energy Efficiency

While standardization has its benefits, choosing the best motor for each application is still crucial. With most applications requiring the use of IE4 motors due to energy efficiency standards, it is still critical to size the geared motor accurately to prevent losing the energy efficiency benefit. To provide the required power and speed, integrated frequency inverters are preferable over larger motors. Even when energy is cheap, preparing for future energy shocks should be a top concern.

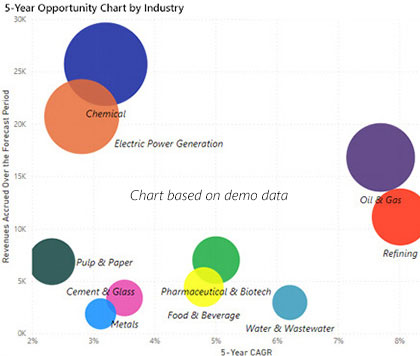

ARC’s market growth outlook service delivers an in-depth market opportunity analysis including five-year market and technology forecasts and 3-year history trend lines where available. Besides providing an in-depth analysis of the market opportunity provided by each technology, this service allows technology suppliers to analyze their own customized markets consisting of multiple technologies. For example, customers can view different market scenarios by adding or removing technology markets from the analysis, providing them a Total Available Market (TAM) view of their own served market. A list of the available market growth outlook services can be seen in the list below.

This service is designed to help accelerate your organization's ability to understand an up-to-date view of the market opportunity provided by your current product portfolio and analyze how your company’s market opportunity would change if you were to acquire or divest a particular product line. The service will also help you identify and capitalize on emerging markets, whether these markets are based on an emerging technology, region, vertical industry, or application. Built upon a proprietary market model and ARC’s field proven primary research, this service helps product and marketing managers optimize their business plans by identifying the opportunities provided by emerging trends. ARC’s reputation as the preeminent independent provider of market growth opportunity analyses for nearly four decades also provides greater weight to your business plans. ARC’s market growth outlook services are available in a variety of formats depending on whether you view your market opportunities via different technologies, industries, or world regions.

In addition, ARC has a strong history of providing customized market opportunity reports and services to meet your specific needs. For example, you may sell your products only to specific industries and/or in only one or two regions. You tell us your served markets and ARC can quickly configure a report or service designed to best serve your served market.

ARC provides several versions of these reports and services depending on your role in the organization. Executive Views are high level market opportunities designed to help executives quickly identify key trends and market opportunities around the world. In-depth market opportunity analyses provide marketing and product managers more detailed technology specific market information to plan marketing and product development strategies. The following table shows more specific information included in each version.

| Market Growth Outlook Analysis | Use Cases | Target Role |

| Worldwide Market Growth Outlook by Industry & Region with 3-year history where available | In-depth technology-specific strategic growth planning across multiple technologies, applications, regions, and industries | Product & Marketing Managers |

| Worldwide Industry Growth Outlook by Region with 3-year history where available | Strategic technology growth planning for markets defined by a single or multiple vertical industries | Industry Managers |

| Regional/Country Market Growth Outlook by Technology & Industry with 3-year history where available (includes country data) | Strategic technology growth planning for markets defined by a single or multiple world regions | Regional & Country Sales Managers |

| Market Growth Outlook Executive View | Strategic Total Available Market (TAM) growth planning dashboard covering multiple vertical industries, technologies, and world regions | Executives |

ARC’s Competitive Analysis services deliver in depth competitive analyses across multiple technologies, applications, regions, and industries. Besides providing an in-depth analysis of the market opportunity provided by each technology, this service allows technology suppliers to analyze their own customized markets consisting of multiple technologies. For example, customers can view different market scenarios by adding or removing technology markets from the analysis, providing them a Total Available Market (TAM) view of their own served market. A list of the available market growth outlook services can be seen in the list below.

This service is designed to help product and marketing managers identify their company’s market positioning across multiple views within their Serviceable Available Market (SAM). Built upon a proprietary market model and ARC’s field proven primary research, this service helps product and marketing managers optimize their business plans by identifying how their company’s market position would change if the company were to acquire or divest a particular product line or technology. ARC’s reputation as the preeminent independent provider of competitive market benchmarking for nearly four decades lends greater weight to your business plans. ARC’s market competitive services are available in a variety of formats depending on whether you view your market opportunities via different technologies, industries, or world regions.

In addition, ARC has a strong history of providing customized market opportunity reports and services to meet the specific needs of our clients. For example, you may sell your products only to specific industries and/or in only one or two regions. You tell us your served markets and ARC can quickly configure a report or service designed to best serve your served market.

ARC provides several versions of these reports and services depending on your role in the organization. Executive Views are high level market competitive analyses designed to help executives quickly assess their SAM by world region, technology, or vertical industry. In-depth competitive market analyses provide marketing and product managers more detailed technology specific benchmarking information to plan marketing and product development strategies. The following table shows more specific information included in each version.

| Competitive Analysis | Use Cases | Target Role |

| Worldwide Competitive Analysis by Technology | In-depth competitive market analysis that quantifies how your company’s market position has changed over time across multiple technologies, applications, regions, and industries | Product & Marketing Managers |

| Worldwide Competitive Analysis by Industry | Strategic technology-based competitive analyses for markets defined by a single or multiple vertical industries | Industry Managers |

| Regional/Country Competitive Analysis by Industry | Strategic technology-based competitive analyses for markets defined by a single or multiple world regions | Regional Sales Managers |

| Competitive Analysis Executive View | Strategic Serviceable Available Market (SAM) analysis dashboard covering multiple vertical industries, technologies, and world regions | Executives |

Worldwide Research Focus Areas

Strategic Analysis

- Executive Overview

- Market Trends

- Buyer Strategies

- Supplier Strategies

- Growth Contributors and Inhibitors

Competitive Analysis

- Market Shares of the Leading Suppliers

- Market Shares by Region

- North America

- Europe, Middle East, Africa

- Asia

- Latin America

- Market Shares by Connectivity

- Ethernet

- Fieldbus

- Hard Wired

- Market Shares by Value Add

- AC Drive

- Gearbox

- Motor

- Market Shares by Gear Type

- Bevel

- Helical

- Parallel-shaft

- Planetary

- Worm

- Market Shares by Industry

- Aerospace & Defense

- Automotive

- Buildings

- Cement & Glass

- Chemical

- Electric Power Generation

- Electric Power T&D

- Electronics & Electrical

- Fabricated Metals

- Food & Beverage

- Logistics

- Machinery

- Metals

- Mining

- Oil & Gas

- Pharmaceutical & Biotech

- Plastics & Rubber

- Printing

- Pulp & Paper

- Refining

- Semiconductors

- Textiles

- Water & Wastewater

- Market Shares by Machinery Segment

- Market Shares by Power Type

- Market Shares by Torque

- Market Shares by Sales Channel

- Market Shares by Customer Type

Market Forecasts & Histories

- Total Shipments of Geared Motors

- Shipments by Region

- North America

- Europe, Middle East, Africa

- Asia

- Latin America

- Shipments by Connectivity

- Ethernet

- Fieldbus

- Hard Wired

- Shipments by Value Add

- AC Drive

- Gearbox

- Motor

- Shipments by Gear Type

- Bevel

- Helical

- Parallel-shaft

- Planetary

- Worm

- Shipments by Industry

- Aerospace & Defense

- Automotive

- Buildings

- Cement & Glass

- Chemical

- Electric Power Generation

- Electric Power T&D

- Electronics & Electrical

- Fabricated Metals

- Food & Beverage

- Logistics

- Machinery

- Metals

- Mining

- Oil & Gas

- Pharmaceutical & Biotech

- Plastics & Rubber

- Printing

- Pulp & Paper

- Refining

- Semiconductors

- Textiles

- Water & Wastewater

- Shipments by Machinery Segment

- Shipments by Power Type

- Shipments by Torque

- Shipments by Sales Channel

- Shipments by Customer Type

Industry Participants

The research identifies all relevant suppliers serving this market.

Regional Research Focus Areas

Strategic Analysis

Competitive Analysis

- Leading Suppliers in Region

- Industry Shares in Region

- Country Shares in Region

- Leading Suppliers by Industry

Market Forecasts & Histories

- Market Forecast & History by Country

- Market Forecast & History by Industry

Industry Participants

List of countries & currencies included in each region: MIRA-Country

For More Information

To speak with the author or to purchase the Geared Motors Market Research, please contact us.

Learn more about ARC In-depth Research at Market Data Services

Learn more about ARC Strategic Services at Advisory Services for Industry Leaders