This in-depth market data research is split into two key modules: Market Growth Outlook and Competitive Analysis. Each of these modules is further configured into several sub-modules to meet the needs of executives as well as marketing, sales, and product development managers. All of these modules and sub-modules may be purchased as a bundle or separately. A brief description of these modules, sub-modules, and their use cases is included below.

The Integral Horsepower Low Voltage Motors market research delivers current market analysis plus a five year market and technology forecast. It is available in multiple editions including worldwide, all regions, and most major countries.

Higher Energy Efficient Low Voltage Motors Support Sustainability Initiatives

ARC’s research on the Integral Horsepower (IHP) Low Voltage Motors market provides strategic insight into the market and includes quantitative assessments and forecasts of various segmentations, as well as analyses of world regions and industries. Products included in this market analysis are alternating current (AC) asynchronous and synchronous motors, gearmotors, and direct current (DC) motors operating at voltages of 690 V. or less. Growth tempered with sustainability is the objective of forward-thinking companies. More people, especially in emerging nations are shifting to cities, often for economic benefits, and this dynamic is creating a demand for better urban infrastructure. This increases the direct use of motors in various applications as well as supporting industries, such as metals, mining, cement & glass, and chemical. Also, in most developed countries, many aging infrastructures need to be modernized. Sustainability initiatives for carbon neutrality, hydrogen energy projects, strong recovery from the machinery and automotive segments further support this high growth.

Energy efficiency of low voltage motors has increased dramatically in recent years due to technological advances and regulations to improve energy efficiency. Higher energy-efficient motors, including IE3 and IE4 are becoming increasingly important in the market. A handful of suppliers also have IE5 and/or IE5 complaint motors that are designed to meet IE5 ultra- premium energy efficiency standards.

Integral Horsepower Low Voltage Motors Strategic Issues

In addition to providing a five-year market forecast, the IHP Low Voltage Motors market research provides detailed quantitative current market data and addresses key strategic issues as follows.

In addition to providing a five-year market forecast, the IHP Low Voltage Motors market research provides detailed quantitative current market data and addresses key strategic issues as follows.

Select Suitable Motors

Both external and internal conditions need to be considered when selecting a drive or motor to run a machine or process. A drive or a motor which is correctly dimensioned and mounted will work properly throughout its lifetime. For example, a motor must be chosen to suit the attached machine’s startup power levels and operational power output requirements. An improperly matched motor can cause significant damage to the machine or result in stalling and failure. With electric motors, it is always worth looking at the system as a whole and choosing the correct size of a motor for a desired application. An oversized motor will consume excess energy while only delivering a fraction of the available power, and an underpowered motor will waste energy by running too hot. Hence, selecting a suitable motor can save some energy and operational costs.

Identify Critical Applications and Use Condition Monitoring

Identifying critical applications needs to be a priority—making sure that these are equipped with reliable, correctly sized gearmotors and the lines are designed with redundancy, if necessary. To reduce and control exchange times to avoid loss of production, condition monitoring is essential on those devices. Most gearmotors offer integrated condition monitoring or can be integrated into a third-party system. While this has become the standard, the correct and continuous usage of this feature has not been achieved by everyone, especially in critical applications—preferably, predictive condition monitoring needs to become the standard.

Standardization

It is important to find the balance between standardizing on a selected number of motors and using individual solutions for each application. Standardization has the advantage that the number of spare parts is reduced, which lowers costs. On the other hand, standardization on a small number of motors will result in using oversized motors for a majority of applications. This will increase energy consumption, especially with regard to expensive IE4 motors that lose the efficiency gain, when used below full load. This also means that when standardizing on a number of motors, paying the premium for high-efficient motors is a waste of money.

ARC’s market growth outlook service delivers an in-depth market opportunity analysis including five-year market and technology forecasts and 3-year history trend lines where available. Besides providing an in-depth analysis of the market opportunity provided by each technology, this service allows technology suppliers to analyze their own customized markets consisting of multiple technologies. For example, customers can view different market scenarios by adding or removing technology markets from the analysis, providing them a Total Available Market (TAM) view of their own served market. A list of the available market growth outlook services can be seen in the list below.

This service is designed to help accelerate your organization's ability to understand an up-to-date view of the market opportunity provided by your current product portfolio and analyze how your company’s market opportunity would change if you were to acquire or divest a particular product line. The service will also help you identify and capitalize on emerging markets, whether these markets are based on an emerging technology, region, vertical industry, or application. Built upon a proprietary market model and ARC’s field proven primary research, this service helps product and marketing managers optimize their business plans by identifying the opportunities provided by emerging trends. ARC’s reputation as the preeminent independent provider of market growth opportunity analyses for nearly four decades also provides greater weight to your business plans. ARC’s market growth outlook services are available in a variety of formats depending on whether you view your market opportunities via different technologies, industries, or world regions.

In addition, ARC has a strong history of providing customized market opportunity reports and services to meet your specific needs. For example, you may sell your products only to specific industries and/or in only one or two regions. You tell us your served markets and ARC can quickly configure a report or service designed to best serve your served market.

ARC provides several versions of these reports and services depending on your role in the organization. Executive Views are high level market opportunities designed to help executives quickly identify key trends and market opportunities around the world. In-depth market opportunity analyses provide marketing and product managers more detailed technology specific market information to plan marketing and product development strategies. The following table shows more specific information included in each version.

| Market Growth Outlook Analysis | Use Cases | Target Role |

| Worldwide Market Growth Outlook by Industry & Region with 3-year history where available | In-depth technology-specific strategic growth planning across multiple technologies, applications, regions, and industries | Product & Marketing Managers |

| Worldwide Industry Growth Outlook by Region with 3-year history where available | Strategic technology growth planning for markets defined by a single or multiple vertical industries | Industry Managers |

| Regional/Country Market Growth Outlook by Technology & Industry with 3-year history where available (includes country data) | Strategic technology growth planning for markets defined by a single or multiple world regions | Regional & Country Sales Managers |

| Market Growth Outlook Executive View | Strategic Total Available Market (TAM) growth planning dashboard covering multiple vertical industries, technologies, and world regions | Executives |

ARC’s Competitive Analysis services deliver in depth competitive analyses across multiple technologies, applications, regions, and industries. Besides providing an in-depth analysis of the market opportunity provided by each technology, this service allows technology suppliers to analyze their own customized markets consisting of multiple technologies. For example, customers can view different market scenarios by adding or removing technology markets from the analysis, providing them a Total Available Market (TAM) view of their own served market. A list of the available market growth outlook services can be seen in the list below.

This service is designed to help product and marketing managers identify their company’s market positioning across multiple views within their Serviceable Available Market (SAM). Built upon a proprietary market model and ARC’s field proven primary research, this service helps product and marketing managers optimize their business plans by identifying how their company’s market position would change if the company were to acquire or divest a particular product line or technology. ARC’s reputation as the preeminent independent provider of competitive market benchmarking for nearly four decades lends greater weight to your business plans. ARC’s market competitive services are available in a variety of formats depending on whether you view your market opportunities via different technologies, industries, or world regions.

In addition, ARC has a strong history of providing customized market opportunity reports and services to meet the specific needs of our clients. For example, you may sell your products only to specific industries and/or in only one or two regions. You tell us your served markets and ARC can quickly configure a report or service designed to best serve your served market.

ARC provides several versions of these reports and services depending on your role in the organization. Executive Views are high level market competitive analyses designed to help executives quickly assess their SAM by world region, technology, or vertical industry. In-depth competitive market analyses provide marketing and product managers more detailed technology specific benchmarking information to plan marketing and product development strategies. The following table shows more specific information included in each version.

| Competitive Analysis | Use Cases | Target Role |

| Worldwide Competitive Analysis by Technology | In-depth competitive market analysis that quantifies how your company’s market position has changed over time across multiple technologies, applications, regions, and industries | Product & Marketing Managers |

| Worldwide Competitive Analysis by Industry | Strategic technology-based competitive analyses for markets defined by a single or multiple vertical industries | Industry Managers |

| Regional/Country Competitive Analysis by Industry | Strategic technology-based competitive analyses for markets defined by a single or multiple world regions | Regional Sales Managers |

| Competitive Analysis Executive View | Strategic Serviceable Available Market (SAM) analysis dashboard covering multiple vertical industries, technologies, and world regions | Executives |

Worldwide Research Focus Areas

Strategic Analysis

- Executive Overview

- Market Trends

- Buyer Strategies

- Supplier Strategies

- Growth Contributors and Inhibitors

Competitive Analysis

- Market Shares of the Leading Suppliers

- Market Shares by Region

- North America

- Europe, Middle East, Africa

- Asia

- Latin America

- Market Shares by Revenue Category

- Hardware

- Services

- Market Share by Efficiency Class

- IE1 (Below EPAct)

- IE2 (EPAct)

- IE3 (NEMA Premium)

- IE4 (Super Premium)

- Direct Current

- Market Shares by Power Rating

- 0.75-5 kW

- >5–40 kW

- >40-200 kW

- >200-600 kW

- >600 kW

- Market Shares by Type

- Motor

- Motor + IntegratedDrive

- Gearmotor + IntegratedDrive

- Gearmotor

- Market Shares by Hardware Frame Type

- IEC

- NEMA

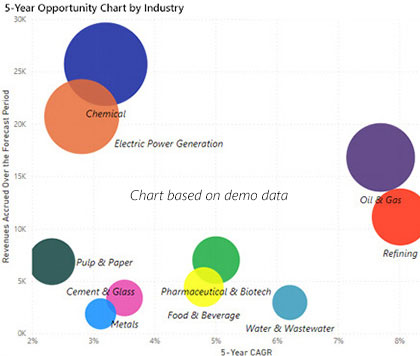

- Market Shares by Industry

- Automotive

- Building Automation

- Cement & Glass

- Chemical

- Electric Power Generation

- Electric Power T&D

- Electronics & Electrical

- Food & Beverage

- Machinery Manufacturing

- Marine

- Metals

- Mining

- Oil & Gas

- Pharmaceutical & Biotech

- Plastic & Rubber

- Printing & Publishing

- Pulp & Paper

- Refining

- Textiles

- Water & Wastewater

- Market Shares by Machinery Segment

- Market Shares by Hazardous Rating

- Market Shares by Customer Type

- Market Shares by Sales Channel

Market Forecasts and History

- Total Shipments of Low Voltage Motors

- Shipments by Region

- North America

- Europe, Middle East, Africa

- Asia

- Latin America

- Shipments by Revenue Category

- Hardware

- Services

- Shipments by Efficiency Class

- IE1 (Below EPAct)

- IE2 (EPAct)

- IE3 (NEMA Premium)

- IE4 (Super Premium)

- Direct Current

- Shipments by Power Rating

- 0.75-5 kW

- >5–40 kW

- >40-200 kW

- >200-600 kW

- >600 kW

- Shipments by Type

- Motor

- Motor + IntegratedDrive

- Gearmotor + IntegratedDrive

- Gearmotor

- Shipments by Hardware Frame Type

- IEC

- NEMA

- Shipments by Hazardous Rating

- Shipments by Industry

- Automotive

- Building Automation

- Cement & Glass

- Chemical

- Electric Power Generation

- Electric Power T&D

- Electronics & Electrical

- Food & Beverage

- Machinery Manufacturing

- Marine

- Metals

- Mining

- Oil & Gas

- Pharmaceutical & Biotech

- Plastic & Rubber

- Printing & Publishing

- Pulp & Paper

- Refining

- Textiles

- Water & Wastewater

- Shipments by Machinery Segment

- Shipments by Sales Channel

- Shipments by Customer Type

Industry Participants

The research identifies all relevant suppliers serving this market.

Regional Research Focus Areas

Strategic Analysis

Competitive Analysis

- Leading Suppliers in Region

- Industry Shares in Region

- Country Shares in Region

- Leading Suppliers by Industry

Market Forecast and History

- Market Forecast and History by Country

- Market Forecast and History by Industry

Industry Participants

List of countries & currencies included in each region: MIRA-Country

For More Information

To speak with the author or to purchase the Integral Horsepower Low Voltage Motors Market Research, please contact us.

Learn more about ARC In-depth Research at Market Data Services

Learn more about ARC Strategic Services at Advisory Services for Industry Leaders