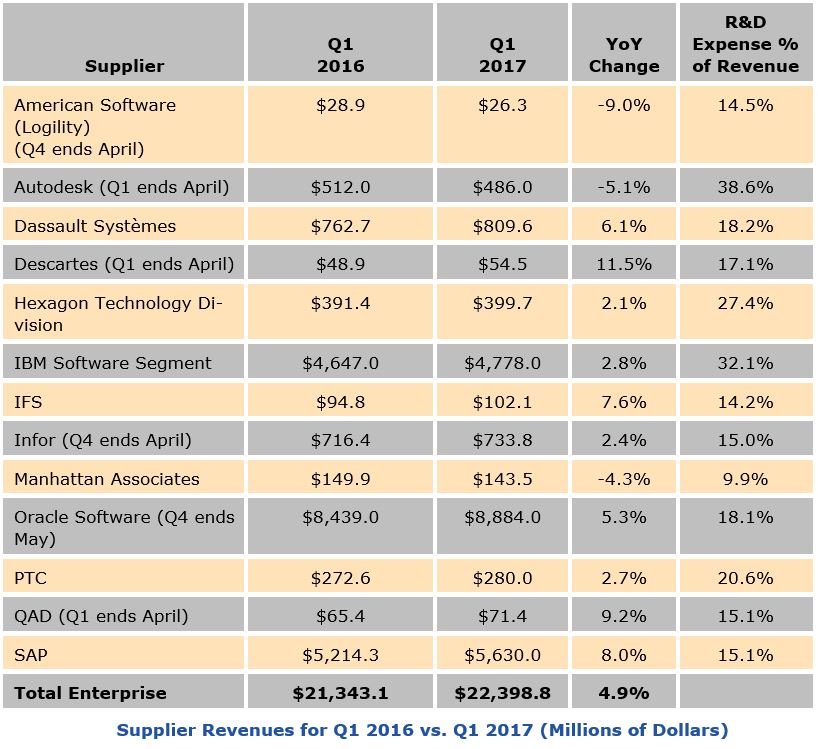

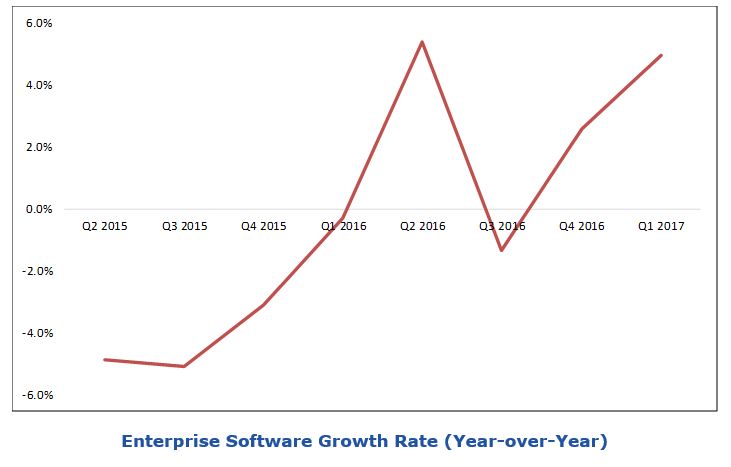

Suppliers included in this report recorded combined quarterly revenue of slightly over $22 billion, representing 4.9 percent year-over-year growth.

This ARC Advisory Group report discusses the most recent quarterly revenue results of the major publicly traded

While this report focuses on the enterprise software portion for the respective companies mentioned, the R&D expenses shown are a factor of total company revenues.

American Software (Logility) reported total revenue of $26.3 million for the quarter ended April 2017. This represents a decline of 9.0 percent from the same period last year. License revenues declined by 41.2 percent to $3.9 million. Services and other revenues also decreased slightly by 0.5 percent to $11.9 million and maintenance revenues increased by 1.6 percent. Cloud Services Annual Contract Value (ACV) increased approximately 59 percent to $6.1 million for the quarter compared to $3.8 million in the same quarter of the previous year.

Autodesk reported total revenue of $486.0 million for the quarter ended April 2017. This represents a decline of 5.1 percent from the same period the previous year. Revenue from the Platform Solutions and Emerging Business (PSEB) segment, which includes the Autodesk Design Suite, increased by 7.0 percent to $92 million. Revenue from the Architecture, Engineering, and Construction (AEC) segment declined by 6.4 percent to $205 million. Finally, the Manufacturing segment experienced a 10.1 percent decline to $142 million. EMEA revenue was $190 million, Americas $210 million, and APAC $86 million. Total GAAP spend (cost of revenue plus operating expenses) was $605 million, a decrease of 8.6 percent compared to the first quarter last year. Subscription plan annualized recurring revenue (ARR) was $692 million, an increase of 104 percent compared to the same period last year. Total ARR was $1.74 billion, an increase of 18 percent compared to the first quarter last year as reported.

Dassault Systèmes achieved total revenue of $809.6 million for the quarter, representing a 6.1 percent year-over-year growth rate. Software-related revenue (new and recurring licenses and maintenance) increased by 5.8 percent to $714.1 million. Services revenues increased by 9.1 percent to $95.5 million. By product line in euros, CATIA revenues increased by 6.8 percent, while ENOVIA decreased by 3.8 percent, and SOLIDWORKS increased by 15 percent. Geographically, revenues from the Americas increased by 8.6 percent, Europe by 8.7 percent, and Asia by 11.7 percent in reporting currency. The company’s strong revenue results are due to industry diversification and positive contributions by all product lines.

Descartes reported revenues of $54.5 million for the quarter ending in April 2017. This represents 11.5 percent growth over the same period in the prior year. Services revenues of $52.8 million represent an 11.2 percent year-over-year increase. Quarterly revenues from the US increased from $24.1 million to $29.7 million, while EMEA declined from $18.9 million to $18.7 million and Canada from $3.6 to $3.4 million. APAC increased from $2.3 million to $2.7 million.

Hexagon’s Industrial Enterprise Solutions (IES) division consists of the manufacturing- and engineering-focused businesses: Hexagon Metrology and Intergraph PP&M. The division focuses on engineering software for creating and leveraging information critical for planning, constructing, and operating plants and process facilities, as well as for CAD (computer-aided design) and CAM (computer-aided manufacturing) software and metrology systems. The division reported $399.7 million in revenue for the quarter. This represents an increase of 2.1 percent year over year. In reporting currency (euro), the company increased its revenues by 5.7 percent. Geographically, 34.2 percent of revenues came from the Americas, 38.0 percent from EMEA, and 27.8 percent from Asia. Hexagon acquired Multivista, provider of visual cloud-based construction documentation solutions, in August 2016.

IBM’s Software segment reported revenue of $4.77 billion in external sales for the quarter. This represents an increase of 2.8 percent over the same period last year. Under the company’s new segment reporting structure, total software no longer exists as a segment. Instead, the company’s software revenue is included within the technology services & cloud platforms, cognitive solutions, and systems segments. Given the current focus on IBM’s software revenue performance, the company will continue to report total software revenue performance throughout 2017. It consists of solutions software, which increased by 2.8 percent. Integration software, which is a part of technology services & cloud platforms, decreased by 2.0 percent. Operating systems software, part of the systems business, declined by 16.1 percent.

IFS reported $102.1 million in revenue for the quarter, which represents a 7.6 percent year-over-year increase. License revenue increased by 76.5 percent while Maintenance declined by 4.0 percent and Consulting revenue declined by 1.2 percent. North Europe contributed most to the increase in consulting revenue in the reporting currency, which was adjusted for revenue coming from the acquisition of VisionWaves.

Infor reported revenue of $733.8 million for the quarter ending April 2017. This represents a 2.4 percent growth from the prior year. Revenues from license fees increased by 3.6 percent, product update and support declined by 2.2 percent, and consulting services and other fees increased by 10.3 percent. From a regional perspective, revenues from the Americas contributed 63.08 percent, EMEA 31.0 percent, and Asia Pacific 6.0 percent to Infor’s revenues.

Manhattan Associates’ revenues decreased by 4.3 percent year over year to $143.5 million. Revenues from the Americas increased by 2.0 percent, EMEA declined by 14.0 percent, and APAC increased by 2.0 percent. Digital commerce and technology modernization programs continue to drive significant long-term growth opportunities for the company. Management stated that the demand for omni-channel, store, and distribution management solutions continued to increase. Global license revenues increased by 10.5 percent to $22.8 million. Services revenues decreased by 6.4 percent to $108.8 million. Hardware & other revenues decreased by 8.5 percent to $11.9 million.

Oracle’s Software segment recorded $8.88 billion in revenues for the quarter ending May 2017. This represents 5.3 percent increase over the same period the previous year. New software licenses declined by 5.1 percent to $2.6 billion, and cloud software subscriptions and platform service grew by 72.2 percent to $1.18 billion. Infrastructure-as-a-Service (IaaS) revenues increased by 2.4 percent to $173 million. From a regional perspective, total software revenues increased by 5.6 percent in the Americas, by 0.3 percent in EMEA, and by 14.3 percent in Asia Pacific.

PTC reported revenues of $280.0 million for the quarter ending in March 2017. This represents a moderate increase of 2.7 percent year over year. Subscription & license revenue increased by 45.1 percent to $92 million. Support revenue declined by 12.2 percent. Professional services declined by 3.3 percent. Bookings growth of 11 percent year-over-year was driven by another strong quarter in IoT, with new bookings growing faster than the estimated 40 percent market growth rate; as well as solid bookings results in CAD and core PLM, which both grew at or above the estimated market growth rates.

QAD reported total revenue of $71.4 million for the quarter ending in April 2017. This represents an overall increase of 9.2 percent from the same period the previous year. QAD’s license revenues increased by 33.4 percent, subscription revenues grew by 33.5 percent. Revenues from professional services were $18.9 million vs. $17.1 million last year, an increase of 10.2 percent. Maintenance and other revenues declined by 2.8 percent. By vertical, high tech and industrial represented 33 percent; automotive 32 percent; consumer products and food & beverage 21 percent; and life sciences 14 percent. By geography, North America represented 46 percent, EMEA 30 percent, Asia Pacific 17 percent, and Latin America 7 percent of total revenues.

SAP’s quarterly revenue increased by 8.0 percent to $5.6 billion. Software licenses and support revenues increased by 2.9 percent to $2.9 billion. Meanwhile, cloud subscriptions and support revenues increased from $747 million to $964 million. In reporting currency (euro), the company’s total software, cloud, and services revenues increased by 11.8 percent. From a regional perspective, revenues in the Americas increased by 9.3 percent, Asia Pacific Japan (APJ) region by 13.3 percent, and EMEA by 13.4 percent.

Most enterprise software suppliers included in this report experienced year-over-year growth during the first quarter of 2017. While some of the on-premise revenues continue a downward trend, cloud/subscription-based revenues continue to grow. The relationship between the euro and the US dollar appears to have stabilized. Some of the industry trends affecting revenues include a widespread transition from perpetual licensing to subscriptions, industry consolidation through mergers and acquisitions, and corporate technology investment cycles.

ARC will continue to monitor these trends and associated supplier performance in the coming quarters.

If you would like to buy this report or obtain information about how to become a client, please Contact Us

Keywords: Enterprise Software, Quarterly Supplier Revenues, Asia Pacific, Europe, Middle East & Africa, Latin America, North America, ARC Advisory Group.