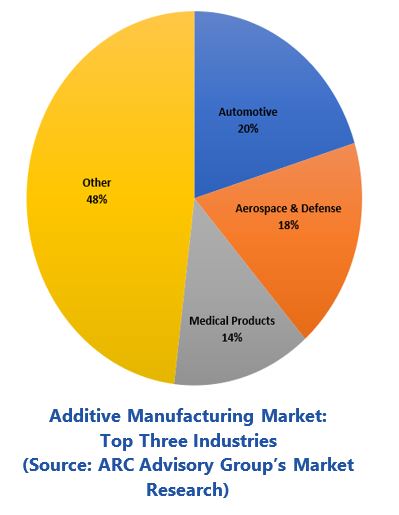

Additive manufacturing (AM) technology is being adopted across many different industries, providing unique advantages and challenges for each. ARC Advisory Group research indicates that, in 2018, additive manufacturing in automotive and aerospace & defense industries were the two largest markets. Combined, these two industries accounted for more than one-third of industrial system sales by revenue. Thanks to advances in 3D printing technologies, a growing foundation of knowledge, and the emergence of standards, additive manufacturing is becoming increasingly profitable and attractive for the respective industries. Despite the progress in each of these areas, significant gaps remain – general and industry-specific - that must be addressed to be able to sustain the rapid growth of the AM market over the next five to ten years.

The 3D printing of tools used in traditional manufacturing processes is developing rapidly. This offers tremendous potential for automotive OEMs and tier 1 suppliers alike, since it can shorten development cycles significantly. As a result, AM could help the automotive industry optimize the very capital-intensive development of new products.

Contrary to popular belief, additive manufacturing is not the “holy grail” when it comes to reducing costs and cost reductions are not the main justification for implementing AM. The advantages of AM lie elsewhere, namely in the ability to produce very complex and/or light-weight structures. As a result, AM will not entirely replace traditional manufacturing methods in the automotive industry in the coming years but complement them.

Additive manufacturing must still overcome several hurdles related to quality assurance and productivity. Currently, we’re seeing a very low degree of automation in AM and the process stability is not always guaranteed. Several industry initiatives aim to overcome these hurdles.

These include the NextGenAM project in Germany, a joint initiative between automotive supplier, Daimler; aerospace supplier, Premium AEROTEC; and technology provider, EOS. The aim of the project is to develop a complete automated system to produce aluminum components for the automotive and aerospace industries. The project’s pilot plant consists of machines for additive production, post-processing, and quality assurance. The pilot plant automates and integrates the interactions between most steps in the process, enabling complex, lightweight components to be produced automatically with a high degree of stability.

Post-processing costs remain a big issue. Most of today's AM technologies require separate post-processing steps, although this depends on the application. This can include removing support structures, machining to tolerances, or treating surfaces. Each post-processing process represents additional costs and requires additional tools, manpower, and expertise.

During quality assurance, the reproducibility of the components must be ensured. This can only be achieved by standardizing and safeguarding processes and materials and by further development of the machines, with a focus on reliability and speed. Machines must reach a demonstrable level of technology maturity and be easily integrated into the manufacturer’s overall automation environment.

For future series production, AM could support the transformation away from the classical long assembly lines to island production. In-stead of a long production line, one could, for example, use small AM cell units for production.

Some studies show that AM currently accounts only for a very small share (less than 1 percent ) of the total production market of the automotive sector. However, some experts already see great potential for AM in automotive production. It can be estimated that the share could increase to up to 5 percent for all "traditional" produced components in the short to medium term. There is clearly a large gap between what would already be possible today with the available technology and what is actually being used.

That's why companies and research institutions around the world are working hard to translate 3D printing into industrialized and highly automated production processes for the automotive industry. A good example of this is the Industrialization and Digitalization of Additive Manufacturing (IDAM) project from Germany. Twelve partners want to use the project to lay the foundation for further technological development and integration of AM in series production in the automotive sector.

The targeted quantities speak of the high expectations of the joint project. In the future, the AM production lines should make it possible to produce at least 50,000 components per year in common parts production and more than 10,000 individual and spare parts under the highest quality and cost pressure. By taking a holistic view of the automotive production line, the project participants aim to reduce the manual share of activities along the process chain from currently around 35 percent to less than 5 percent. In addition, the unit costs of the 3D-printed metal components are to be more than halved.

Aerospace & defense, currently the second largest industrial market for AM, leads the way when it comes to metal-based additive technology for production use. Among the industry innovators is GE Aviation, which will have printed an estimated 100,000 parts by 2020. Similarly, Airbus has already designated several hundred aircraft components to be replaced with AM-produced, titanium parts. Companies within the aerospace & defense supply chain have also invested in AM. For example, Moog, a motion and fluid controls supplier, owns and operates an AM factory with twenty systems in addition to its conventional manufacturing facilities.

The aerospace & defense industry is among the fastest growing markets for AM. From a macroeconomic perspective, this is due in large part to the anticipated global growth of the industry. The commercial aircraft order backlog remains at near all-time highs and is likely to stay that way to accommodate the rapidly increasing demand for air travel. At the same time, geopolitical tensions continue to drive increases in defense spending across the globe.

While these trends drive the demand, competition in the industry revolves around product innovation and optimization. Many organizations expect that AM will be crucial to achieving product differentiation. Thus, the potential to carve out future market share through AM-based innovation today warrants substantial investment.

ARC Advisory Group clients can view the complete report at ARC Client Portal

If you would like to buy this report or obtain information about how to become a client, please Contact Us

Keywords: Additive Manufacturing, Automotive, Aerospace & Defense, 3D Printing, ARC Advisory Group.